Archive for August 2010

Coaching You to the Next Level

I want to take a bit of a side-trip from my usual hard-hitting commercial mortgage loan and investment property advice. I had the opportunity to spend a few days at the Pacific Life Open tennis tournament in Indian Wells, California last week while on vacation and noticed a minor, but significant change in the rules. The change was minor in that the players were allowed to ask for a time out to spend time with their coaches between sets. It was significant because the opportunity to speak with their coaches helped several players turn their games around.

For those of you not familiar with the rules of the Association of Tennis Professionals (ATP) coaching during a match was, until recently, against the rules. In fact, a player could be penalized points during a match if the umpire felt that he or she was getting verbal or non-verbal coaching tips during a match.

I point out this concept of âcoachingâ because it has implications in commercial real estate investing.

Have you ever stopped to consider why the best sports figures and Fortune 500 CEOs hire coaches? On the surface it doesnât make sense. These people are the best in the world at what they do, so who is realistically going to be able to help them get even better? Well, as Iâm sure you already know, the reason that they are the best is because they have coaches. Coaches provide several things for those at the top of their profession and those seeking to improve their performance:

1. An external, unemotional perspective to help the one coached see things that they canât perceive about their performance.

2. Information on new aspects of the profession or related professions to help increase performance.

3. Networks of other professionals who can help in areas where the performer is weak.

4. Experience from their past challenges, helping the one coached move ahead faster.

So what does this have to do with commercial real estate?

Whether youâre just starting out or are a seasoned development professional, I can guarantee that youâll get better if you enlist a commercial coach or coaches to help you grow. So where can you find a commercial real estate investment coach?

Let me note that we will soon release coaching programs for investors and loan agents who want to break into and excel in the commercial side of the business (email us here for more information: Coaching@InvestmentPropertyInsider.com). However, until those coaching programs are up and running, here are some suggestions on finding and using a coach to help you get better at investing faster:

1. Consider a retired commercial developer, investor, or real estate agent. You could check with a local commercial real estate office to ask if anyone is retiring soon or has recently left the business. Approach them with the concept of becoming an apprentice and giving them a piece of your profits. They might just enjoy passing on their wealth of experience.

2. Check with a local S.C.O.R.E. office to see if there is anyone who has experience in the commercial real estate investing or development businesses. S.C.O.R.E. is a non-profit business resource group and can be found at www.SCORE.org.

3. Do you know anyone in the business that is already successful? Approach them with the idea of becoming an apprentice, but be very mindful of their time when you do. Again, consider offering them some of your profits as compensation.

4. Consider a personal or business coach for hire. There are a lot of people in this business and some of them are very good. Iâd caution you to be very careful whom you hire, however. Youâre looking for a specialized type of coaching here, more than the generalized life coaching that a lot of these people offer.

I would suggest a few other points in selecting a commercial real estate coach:

1. Make sure that they have actual experience in commercial real estate investment, sales, or lending.

2. Hopefully they will provide you with access to experts in related fields to help you understand all aspects of the business.

3. They should allow you to access other investors so that you can network, share resources, and benefit from each otherâs experience.

4. They should provide an archive of useful information, resources, and tools for your benefit, accessible at any time you need.

As I mentioned, having a coach handy helped several players turn their matches around to advance to the next level at the Pacific Life Open. You should strongly consider your own coach to help you get to the next level in your commercial real estate game, too.

WANT TO USE THIS ARTICLE IN YOUR E-ZINE OR WEB SITE? You can, as long as you include this complete statement with it: ‘ “The Investment Property Insider” is published by Craig S. Higdon, a veteran commercial mortgage broker. He publishes the weekly e-zine and blog, www.InvestmentPropertyInsider.com, for commercial real estate investors, developers, and industry professionals. Visit the blog and get this free report: “The 7 Biggest Loan Mistakes Real Estate Investors Make And How To Avoid Them.” ’

Declining Orange County Apartment Rental Rates

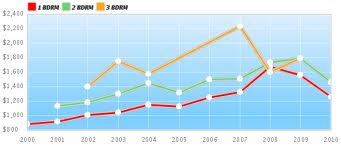

According to the Orange County Register article dated July 25, 2010 by Jonathan Lasner, Orange County apartment rents are down 2% compared to last year at this time. This number is stunning. Orange County has not seen such a large drop since 1940.

This nine month streak of declining rental rates has been discouraging to say the least with June’s annual rate at the smallest decline at 0.4%. Some say that we are now on the rental rise after hitting rock bottom at the close of 2009. This is now becoming a renter’s market and individuals across Southern California are not willing to pay premiums for apartments and condominiums. With the surge of low rent opportunities and homeowners putting their own homes on the rental market scene, landlords are hopeful that this is the answer they have been waiting for.

Nationwide Apartment Rental Market Still Suffers

The question still remains: Are there too many rentals for the amount of renters? With the unemployment rate at an all time low and the economic downturn in full swing, I highly doubt that there are too many options for too few people. Even with the new marketing approach to lure in renters, 6.4% of Orange county’s apartments were empty the 2nd quarter. Even though the OC does not have the lowest vacancy rates in the apartment market, the nation claimed a 7.8% vacancy rate last

Decreased Office Rents Spur Orange County Market

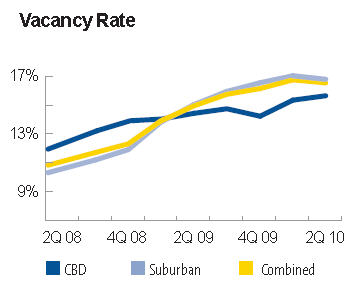

According to the OC Register article dated August 15, 2010,“Rent Cuts Inject Life into Market”, Erika Chavez reports that the Orange County commercial real estate market has been hit hard especially for the first two quarters of 2010. Office vacancy rates have increased from 18.2% from the 1st quarter to 18.4% in the 2nd quarter.

Businesses aggressively signed leases for a reported additional 200,000 square feet causing these elevated vacancy rates for the 2nd quarter. Last year, the average asking rent was estimated at $2.30 per square foot whereas today, it falls right at $2.06 per square foot. Despite the heavy economical blow, the Orange County rental market has seen a glimpse of hope on the horizon.

Landlords are now offering extensive cuts on rent just to entice a steady stream of customers. Businesses are taking advantage of these rent cuts and seeing the potential opportunity for growth and expansion while it is still affordable.

Office Vacancy Rates Remain High Nationwide

Even though renters are eager, the nationwide vacancy rate rose 3.4 percentage points in the last year. Orange County is 4th in the category of most aggressive rent cuts. Leading the nation in rent cuts for the year is Phoenix up 4.2 percentage points, Palm Beach, FL, up 4 percentage points, and Fairfield, Conn, up 3.5 percentage points. Reports have stated that in Orange County office rents have fallen by 1.5% between the 1st and 2nd quarters of this year. These OC cuts are the most drastic by big landlords amongst the 82 nationwide markets surveyed. After 2nd quarter reports came in, Orange County had 20.7% of vacant office space.

On a nationwide scale, these astronomical vacancies have risen for a 10th consecutive quarter which has not been seen by our country for over 17 years. It is going to take a while to see any changes in this bleak market. Landlords are hoping to entice renters with discounted rent rates; however, it will take a lot more than discounted rate to turn the Orange County commercial market around.

__________________________________________________________

For assistance with Commercial Real Estate — investment sales, asset management, commercial REO, commercial BOV’s, commercial broker price opinion. Contact Michael Duhs, Managing Director of East West Commercial at Michael.Duhs@EastWestCommercial.com or http://www.EastWestCommercial.com or (949) 939-8352.

Bank Closures Top 100

Bank closures topped 100 nationwide to date, already exceeding last year’s calendar year. At this time last year, regulators closed 64 banks due to the recession and loans defaulting. The year 2009 had 140 bank closures. This year, however, a total of 101 bank closures have occurred so far.

This year, the U.S. will definitely see numbers far larger.

Forecasted Outlook for 2010

If this year’s bank closure pace continues the number of bank closures expected for 2010 is estimated at 200 or more, which is a 43% increase over last year’s closure.

_________________________________

For assistance with Commercial Real Estate — investment sales, asset management, commercial REO, commercial BOV’s, commercial broker price opinion. Contact Michael Duhs, Managing Director of East West Commercial at Michael.Duhs@EastWestCommercial.com or http://www.EastWestCommercial.com or (949) 939-8352.

Twitter

Twitter

LinkedIn

LinkedIn

YouTube

YouTube

Facebook

Facebook