Archive for 2010

Blackstone’s Second-Quarter Profit Rises 13% as Real Estate Holdings Gain

Blackstone Group LP , the world’s biggest buyout firm, said second-quarter earnings rose 13 percent as the value of some real-estate holdings gained.

Read more on Bloomberg

Signs of slow recovery noted in mid-year report

The overall New Jersey commercial real estate market, while still somewhat colorless, is moving slowly toward an economic upgrade, according to Cushman & Wakefield Inc.’s mid-year research findings.

Read more on The Record and Herald News

Two Colorado Springs commercial brokerages announce merger

Two familiar names in Colorado Springs commercial real estate have joined forces. NAI Highland Commercial Group, a 26-year-old commercial brokerage, and John Egan, a retail specialist and owner of Southwestern Commercial Properties, said Wednesday…

Read more on Colorado Springs Gazette

Business news briefs

The metropolitan Pittsburgh commercial real estate market appears to be faring better than the nation overall. This year’s first-half sales volume of $395.8 million represents the first year-over-year increase in commercial dollar activity in five years and a jump of 54 percent over last year, according to RealSTATs, a local real estate information service.

Read more on Pittsburgh Post-Gazette

By Stephen H. Scholder

Although investor interest in multifamily properties is at an all-time high, the hard-learned lessons of the past several years cannot be ignored. A good location, well-tended units and common areas, and the right amenities are no longer enough to keep occupancy rates up and a property’s value high.

To maximize an asset’s value, the management company must have two main goals:

- meet or exceed budgeted rental income

- meet or exceed budgeted net operating cash flow.

Before this process can begin, owners and investors need to set goals and guidelines for the managers. And that starts with a basic understanding of apartment management dynamics.

What It Takes to Manage Multifamily Properties

The fundamentals of multifamily properties differ greatly from those of commercial properties. For example, in rent control-free markets, apartment leases typically run from six to 12 months, and rents are raised as often and as high as the market will allow. In addition, tenant improvement allowances are virtually nonexistent; “rent-ready” units are leased as is: clean, carpeted, freshly painted, and ready for immediate move in.

Leasing apartments is a relatively simple process, with no intermediaries, no complicated terms, and no negotiations. If one prospect walks away, another most likely won’t.

However, apartment properties comprise large numbers of individual households, and annual turnover is typically 50% to 75% or even higher. As a result, leasing is a continuous process, and providing excellent customer service is critical to securing renewals.

From the manager’s perspective, speed is of the essence: the faster apartments are leased, the higher the property’s cash flow can be. And because prospects often decide to rent a particular apartment for emotional, as well as economic reasons, lease commitments are generally secured relatively quickly.

Measuring Management’s Impact on the Bottom Line

In the vast majority of markets around the country, the appreciation of a specific property’s value depends on the experience and expertise of the management firm responsible for the asset’s day-to-day operations.

There are three major areas of apartment operations that directly affect a property’s economic performance:

- occupancy and rental maximization

- expense management, as it relates to unit turnover

- employee selection and training

To meet each property’s challenges and its owner’s demands, the manager must integrate these disciplines into daily operations. Without proper hiring and training, for example, the management and leasing staff cannot increase the number of new and renewal leases while raising rents and reducing ongoing operating expenses.

Striking the Right Balance Between Rents and Occupancy

From both an investment and an operations standpoint, 95% occupancy is considered the optimum level for multifamily properties. Lenders use the 95% occupancy rate to structure loans, while managers consider 95% to be the balancing point between keeping a property full and focusing on raising rents.

Occupancies must be high and stable to give the manager the ability to command higher rents or even to outperform the market. To get physical occupancy up, however, several things must be in place: curb appeal, a highly trained staff, and an available inventory of “rent-ready” units.

In most situations, prospects will either inadvertently drive by the property, or will be drawn there by an ad or a current resident’s referral. For this reason, curb appeal is vital to draw in prospects.

Properties don’t always have to be freshly painted or brand new, but they must be clean and attractive. This is done by keeping all of the common areas immaculate-from the lawn and leasing office to the sidewalk and swimming pool.

At the leasing office, prospects must find highly trained leasing professionals who can listen and respond to their questions, understand their needs and concerns, and efficiently and skillfully match those needs and concerns to the property’s features.

And, because prospects make rental decisions within a relatively short time period, the property must have an inventory of “rent-ready” apartments to show or, at a minimum, a model.

The other component that properties must have is competitive pricing. Managers can achieve higher-than-average rents by retaining residents who perceive that they are getting higher-than-market value.

How much and how often street rents (the rents quoted to prospects) can be raised is usually a matter of testing. One management company typically raises street rents $5 to $15 per unit every 30 days, depending upon the market and demand for particular floor plans. This continues until the leasing staff acknowledges that closing is difficult; properties with 98% to 100% occupancy suggest higher rents can readily be obtained.

Renewals are typically kept within $10 of the street rate, regardless of how fast rents are rising. This approach gives renewing residents a “preferred customer discount” while being prudent and aggressive about maximizing rental income.

Just three to five years ago, when the apartment supply in many markets exceeded demand, rental rates in these markets just could not be increased. As a result, many owners and managers felt they had maximized rental income by maximizing occupancy, so they focused instead on controlling or even reducing operating expenses.

Although controlling expenses remains a consideration today, many markets have now absorbed their excess supply, and some owners and managers are focusing on obtaining the maximum rent, even if that strategy initially increases resident turnover and operating expenses.

Rent Maximization at Greentree Village

An example of rent maximization is Greentree Village, a 20-year-old apartment property in Colorado Springs with 216 two-bedroom/one-bath units in eight floor plans. The property is exceptionally well located in its marketplace and has very strong curb appeal due to a major renovation in 1991.

As a quality product in a bread-and-butter market, Greentree Village leads its submarket in rents. As of June 1, 1994, Greentree Village’s rents ranged from $515 to $655 per unit, having risen by 17% in 1994, compared to the same period in 1993. This compares with rental growth averages of 7% to 8% in Colorado Springs and 2.4% nationwide in 1993, according to the National Apartment Association.

At Greentree Village, when occupancy hits 98%, management raises rents by $10 to $15 a month, except between the months of November and February. This steady pressure on rents has increased move outs: Greentree averaged about 57% move outs during the first five months of 1994.

Not surprisingly, this property has seen a slight dip in occupancy. Since management consistently raised rents during the first half of 1994, occupancy has remained between 97% and 98%, down from 99% to 100% during the second half of 1993.

Keeping a Lid on Expenses

Reducing operating expenses is crucial to maximizing an apartment property’s value. Through a thorough understanding of apartment operations, leasing, and management, expenses can be tightly controlled.

Some of the larger apartment management companies in the United States have implemented many of the purchasing procedures used by corporate America: in-house purchasing departments that research and negotiate the best terms from suppliers; just-in-time delivery; and immediate use of the purchased item. But there are several basic approaches that any size management company can use to keep property operating costs under control:

- Install and enforce tight checks and balances on all purchases, no matter how small. Every purchase must fit into the property’s approved budget, which specifies the use of all purchases. All capital expenditures and purchases outside budget parameters should require authorization of senior management above the property level.

- Comparison shop for the best prices and vendors, and use just-in-time delivery. By not stockpiling supplies, managers can substantially alleviate potential waste and loss.

- Repair first, and replace only when necessary. Although it is easier and more convenient to replace a broken item for a few dollars, very often the problem can be resolved with parts that cost only a few pennies.

Bearing in mind that each day an apartment sits vacant means from $20 to $40 in unrealized rental income, two important areas of expense management are unit turnover costs and the balanced use of in-house and contract services for “make ready” work.

Because turnover can average 75% per year in a typical apartment property, reducing the number of turnovers is critical, which is why the industry places such a strong emphasis on lease renewals.

A typical, 275-unit property in Phoenix, for example, will turn 192 (or 70%) of its units per year at an average of $580 per turnover (see Table 1). The total cost includes

- lost rent during the vacancy

- advertising and marketing to get prospects through the door (the industry standard is $200 per prospect)

- the leasing agent’s salary and bonus.

Should this property generate $120,000 a month in income, turnover costs would average $100,800 per year, or 7% of total rent. But if management could reduce turnover to 60%, 27 apartments would not have to be leased, saving a minimum of $10,000 each year, although there would still be costs associated with maintenance and leasing personnel.

With fewer vacant apartments to prepare, managers could use maintenance staff more efficiently for non-unit-related projects. Instead of preparing three apartments a month, for example, the staff could paint the trim on two buildings and do the entire property over the course of a year. This would save the $15,000 to $20,000 it would cost to contract the job out on a 275-unit property.

There is an added bonus to reducing the number of turnovers: whereas a property with a high turnover rate requires a full leasing staff and a high level of marketing activity, managers could reduce the number of leasing consultants needed to keep the property full if turnover was significantly lowered.

This careful, balanced use of on-site personnel and contract services, coupled with a sharp eye on expenses, provides a proactive, rather than reactive, approach to the property’s upkeep.

The subsequent rise in the property’s value can be determined by comparing its per-unit expenses to the industry standard of between $1,900 and $2,300, as determined by the Institute of Real Estate Management. For example, the 498-unit Rosehill Pointe Apartments, a nine-year-old complex in the Kansas City area, had expenses of $1,485 per unit at the end of 1993-$815 per unit less than the high end of the industry standard. This equates to annual savings of more than $405,000, and by using a 10% cap rate, results in a more than $4 million increase in value.

Selecting and Training Staff

The selection and training of employees is perhaps the most essential element in multifamily operations, because if this is not done correctly, nothing else will matter. A good management staff is critical, whether they are generating the numbers, sitting behind a desk in the leasing office, sweeping the sidewalk, fixing a faucet, or developing a strategic management plan.

Over the past two years, one property management company has worked closely with an industrial psychologist to develop a profile of top-performing employees. The company uses this profile as a benchmark against which to measure new hires and current employees who may have advancement potential, as well as to determine whether a staff member’s skills would suit one property’s dynamics better than another’s.

The five critical factors that the company has identified as being common to successful employees are:

- reasoning ability

- high energy level

- ability and willingness to take charge

- ability and willingness to take action

- emotional and mental toughness.

This process has been used to successfully fill several critical positions.

Once managers have identified and hired good people, it is essential that they are well trained; unfortunately, there is no training standardin the apartment industry. And, a few years ago when the economics of real estate management became more challenging and profit margins narrowed, many large apartment management companies reduced or eliminated their training departments, and many companies decreased their commitment to training in general.

Others, however, saw the long-term value of training. Many larger companies provide training in three main categories-sales, management/operations, and customer service.

In one firm’s basic customer service training program, employees learn about John and Helen McWaid, a real-life couple who reluctantly left a Dallas-area apartment community after three-and-a-half years to move to a competing property across the street. Their example is important because by losing the McWaids, as typical residents, the management company potentially lost a good portion of hundreds of thousands of dollars in revenue (see Table 2). The McWaids later returned to the property and remain residents to this day.

Achieving a Standard of Excellence

The purpose of intensive employee training, a comprehensive customer service orientation, and a motivated staff is to provide a standard of excellence that remains consistent over time and from property to property.

Managers can see the result of all this effort on the bottom line: during 1993, for example, one nationwide apartment portfolio’s rental income grew by 5.6%, more than twice the national average of 2.3% to 2.4%, as reported by the National Apartment Association.

By applying strategic management techniques, implementing efficient operations procedures, and providing excellent customer service-oriented training to all employees, managers can effectively maximize the value of apartment properties to meet owners’ specific objectives.

________________

If you are looking for an Apartment Broker in southern California, contact Michael Duhs, Managing Broker of East West Commercial.com at (949) 939-8352

www.LosAngelesApartmentsForSale.com

www.OrangeCountyApartmentsForSale.com

www.SanDiegoApartmentsForSale.com

www.RiversideApartmentsForSale.com

www.SanBernardinoApartmentsForSale.com

Export Advantage

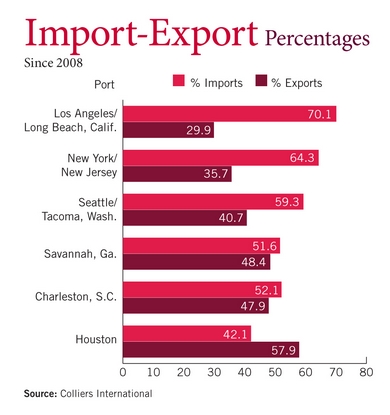

The decline in global trade hit the nation’s industrial markets hard, but not equally hard, according to a Colliers International report. During the global slowdown of the past two years, vacancy rates in port city industrial markets climbed faster than in the overall industrial market. This points up the clear correlation between trade and industrial demand. For every 1 percent change in port TEUs, the standard measure of shipping trade, industrial demand changes 0.33 percent. So the recent 15 percent decrease in TEUs resulted in a 5 percent decline in port city industrial occupancy. But not all port cities experienced the decline equally. In fact, those focusing on exports fared better than those concentrating on imports, as exports to foreign countries remained fairly stable throughout the recession.

Increased import and export business as we come of the recession will benefit Long Beach and Los Angeles County, but also the Inland Empire where most of the goods are warehoused. This is good news for commercial property owners in Los Angeles and San Bernardino. Los Angeles Apartments for Sale, Orange County Apartments for Sale, and San Bernardino Apartments for Sale will benefit.

Michael Duhs, Managing Broker

East West Commercial

(949) 939-8352

Michael.Duhs@EastWestCommercial.com

Interested Investors Should Understand the Critical Components of These Lease Structures.

By Letty M. Bierschenk, CCIM, Kurt R. Bierschenk, CCIM, and William C. Bierschenk, CCIM

Many real estate investors think nothing could be simpler than an investment in a triple-net-leased (also known as NNN) property. Some liken it to buying a bond. While straightforward to own and operate, triple-net-leased properties can be the most challenging type of real estate investment for advisers to structure or — if the lease already exists — to understand. With lease terms as long as 50 or more years when options are taken into account, due diligence is critical, as changes usually cannot be made later on.

To prevent costly mistakes during the lease term, investment advisers must completely master all critical components of the transaction early in the negotiations. These include the client’s objectives for the investment, the lease document, the type of tenant, the physical real estate, and the type of seller.

The Client’s Objective

Investors considering triple-net-leased properties usually have certain objectives in mind that might not be met by typical real estate investments. These may include relief from management obligations, assured income, pride of ownership, and preservation of capital.

Many investors seek a suitable replacement property to complete a tax-deferred exchange. Having sold a management-intensive property such as a multifamily building, they must reinvest in real estate to take advantage of the exchange provisions. They still need the income, but they no longer want a landlord’s responsibilities. In addition, many take pride in having a well-known and respected company as a tenant. Others are most interested in providing an estate for their heirs, and they prefer to have less current income with the highest possible tax deductions from interest and depreciation.

Although all of these objectives can be met through triple-net-leased investments, the variations in different triple-net-leased properties need to be considered as well.

A Lease Primer

Unlike typical commercial real estate transactions, approach the analysis of a triple-net-leased investment with the idea that it is the lease, rather than the building and land, that the investor is purchasing.

Because definitions of triple-net leases differ, be certain that you understand your client’s concept of what the lease should and should not include. You may discover that a triple-net lease does not meet the client’s objectives after all. Also, be aware that the term is widely misused in brokers’ marketing materials.

After finding a potential property, obtain a copy of the lease and analyze it first. Otherwise you can waste time and money on market studies, inspections, and contract negotiations only to find during due diligence that one paragraph in the lease knocks the property out of consideration.

Generally a net lease refers to the arrangement where the tenant pays all or some of a property’s operating costs in addition to rent. Several general gradations of net leases have evolved over the years. These are summarized here, ranked from strongest to weakest, beginning with the lease that gives the tenant absolute responsibility for the real estate in exchange for absolute control.

Bond Lease. The tenant is fully responsible for operating expenses, maintenance, repairs, and replacements for the entire building and site, without limitation.

NNN Lease. These leases follow the bond lease definition except that capital expenditures are limited, usually in the final months of the lease. The lessee is liable for all of the property’s expenses, both fixed and operating.

NN Lease. This lease follows the NNN, except the landlord is responsible for structural components, such as the roof, bearing walls, and foundation.

Modified Net (or Modified Gross) Lease. The tenant pays its own utilities, interior maintenance and repairs, and insurance. The landlord pays everything else, including real estate property taxes.

Regardless of the type of net lease, many fluctuations, such as increasing utility costs and changes in government regulations, cause problems under rigid lease terms over time. Investors must be aware of lease nuances that may seem innocuous but require knowledge and planning in order to avoid future disappointments or disasters. Two such examples are the inflation trap and the taxation burden.

The Inflation Trap. At one time, single-tenant leases were structured with flat income for 25 or 30 years, and then had a series of options at drastically reduced rent, such as 2 percent of the property’s value. The theory was that the loan would be paid off by then, so the landlord’s spendable income would not be reduced. But inflation made this a nightmare for owners. When income was compared to current rent schedules, properties only could be sold at tremendous price reductions.

Today new leases take this possibility into account by specifying periodic rent increases, with options, if any, pegged to “fair market rent” or other indicators that preserve the income level.

Taxation Burden. Local laws and customs also may affect leases. For example, because triple-net tenants are responsible for real estate taxes, including any future increases, a unique situation developed in California with “Proposition 13″ in 1978. It established a new base tax amount of 1 percent of the then value and limited tax increases to 2 percent each year until the property sold. Upon sale, taxes would be recalculated to 1 percent of the new purchase price. This formula, combined with soaring real estate values, meant that tenants were faced with wild leaps in rental rates due solely to changes of ownership, which in no way benefited the tenant.

Today tenants and landlords still are hamstrung over this issue. Tenants generally agree to an allowance for pass-throughs of increases except in the event of a sale. Owners reject these lease provisions, correctly noting that the impact on the net income to a future buyer results in a reduced market value of the real estate.

Triple-Net Tenants

After mastering the lease, the next factor to evaluate is the tenant.

Credit Worthiness. From an investor’s perspective, a triple-net-leased property’s price should reflect the tenant’s ability to meet the terms of the lease. The capitalization rate indicates this variable risk factor, because it directly represents the relationship of the stipulated net income to the price a knowledgeable investor is willing to pay. The higher the risk that a tenant may not be solvent over the long term, the higher the cap rate should be.

A tremendous amount of information is available to assist in evaluating the current and future financial strength of a tenant. If it is a public company, the credit rating is fairly easy to determine through a number of sources, including sites available on the Internet such as http://www.companysleuth.com/, http://www.zacks.com/, and http://www.freeedgar.com/.

The trend toward mergers and divestments adds another dimension to credit reviews. Even though the resulting entity usually is stronger than the original company, the risk of the unknown can be perceived as a negative factor.

If the business is complex or privately held, contact a fee-based tenant underwriting service for added assistance.

Type of Use. Even if the credit rating is substantial, the type of business may affect investment value. From an investment standpoint, a general-purpose use, where tenant improvements easily are convertible to another tenant’s needs, is more desirable than a special-use project. In many special-use cases, the seller passes along the costs of highly specialized improvements to the buyer, who may be unable to recover that portion of the investment over the lease term. Fast-food outlets are a prime example of this problem, but certainly not the only one.

The Physical Real Estate

After reviewing the lease and tenant/landlord compatibility, investors then should evaluate the physical real estate. All categories of office, industrial, retail, multifamily, and hotel properties, and even undeveloped land, can be sold on a triple-net-lease basis, without regard for size, design, or location. However, retail, office, and industrial most often are available in the marketplace.

Businesses that typically lease rather than own their real estate are those that achieve a business-income yield that is substantially higher than the typical real estate yield of 8 percent to 10 percent pre-tax. High-volume retail operations are probably most prevalent. But each investment must be considered individually. For instance, if an investor purchases a special-purpose building with a “theme” construction, the net worth of the company is of prime importance. On the other hand, a food market in a good neighborhood shopping center most likely can withstand even a change of tenancy without significant loss of income.

Similarly, industrial buildings can be classified as warehouse, manufacturing, or research and development space. They come with and without substantial office space and range in size from 10,000 square feet to 500,000 sf. Even warehouse space can be highly specialized today, including high-cube to accommodate the new storage technology, or dock-high local storage for lower volume distribution.

Manufacturing facilities usually have the greatest number of special-purpose characteristics, such as drainage wells, overhead cranes, two-foot-thick concrete floors, and special lighting and exhaust systems that preclude their use by other businesses. The possibility of hazardous materials in any manufacturing process may require consultation with experts who can advise on ways to minimize the landlord’s liability for adverse consequences.

Office buildings, even though they come in all sizes and styles — from free-standing, one-room buildings to lush garden complexes to high-rise palatial headquarters — are easiest to evaluate because they are the most closely tied to location as an indicator.

The purchase price should take into account replacement costs and comparable sales, but be wary of an overmarket rent that cannot be achieved with another tenant in the future. Inflated rents may make the investment return appear desirable. However, if market rents and prices of comparable buildings in the area are substantially lower, the resale value may be less than what the investor paid for the property and the actual yield probably will be lower than other alternative opportunities in the marketplace.

Analyze the effect of overmarket rents on investments by generating a range of internal rate of return calculations, incorporating these assumptions that might impact resale values:

- The tenant renews at a consistent rental rate in the year of sale.

- The property must be released at projected market rent in the year of sale for the same type of use.

- The property must be released for a different use.

Comparing these IRRs demonstrates the marginal value attributed to the current tenant, over and above the demonstrated investment value. Whether or not it is in line with reality can be a subjective call based largely on a client’s “feel” for the company. Quite often, buyers will ignore the importance of the type and location of the real estate when evaluating a triple-net investment. It is not unusual for a fast-food facility to sell at four or five times the replacement value, because the investor is satisfied with the projected return based on the tenant’s strength and length of the lease. But brokers must educate buyers as to the potential problems if such tenants were to go out of business.

Furthermore, if the triple-net facility is located in a shopping center, the owner also must consider the effect of a possible failure of the business location, even if the tenant “goes dark” but continues to pay rent. The loss of traffic, which the credit tenant might have drawn, can impact the sales volumes of every other tenant in the center and destroy the synergism of a previously well-constructed retail mix.

Triple-Net Sellers

Triple-net-leased property sellers fall into three categories: investor/owners of leased properties; owner/users creating sale/leasebacks; and build-to-suit developers.

Investor/Owner. This type of seller presents a known entity for an investor’s analysis. The lease may be a true triple net but with a short remaining primary lease term, requiring either re-leasing or a series of short-term options. Investors can evaluate base rent and expense payment history and may have access to historical sales volumes to assist in determining the likelihood of future income.

Even after the prospective purchaser has analyzed and approved the lease, stipulate a review of an estoppel as a contingency of closing. Many sellers only are willing to involve a tenant during the final stages of the transaction, when they are assured of a sale. However consider what may happen if the estoppel comes back a week before closing and it differs in some way from what the seller’s documents had shown, or worse yet, presents an addendum granting a first right of refusal to purchase the property. Have a clear understanding as to when the seller is willing to submit the form, take note of the response time agreed to by the tenant in the lease, and build this into your contingency timeline.

Owner/User. The triple-net lease is well suited to sale/leasebacks as a way to transition the selling company from having absolute control over its surroundings to a situation where it merely is a “lessee.” Despite the emotional response that may be generated by the change in status, the sale/leaseback provides a number of advantages to both seller and buyer. The seller frees up capital, often 100 percent of the equity in the real estate, to expand or enhance the business. Since a business return, generally speaking, is higher than the typical 8 percent to 10 percent real estate return, the seller can benefit from the lower cost of investment capital.

Sellers and buyers also benefit by being able to customize a transaction, negotiating sale and lease terms that reflect unique landlord and tenant needs. Investors, for example, may agree to a higher purchase price in exchange for stipulated rent increases, rather than taking the risk of cost-of-living increases. They may trade a short initial term for a series of 10-year rather than five-year options. Tenants may feel comfortable with the obligations of a bond-type lease because they know the property.

One potential negative is the possibility that the seller overimproved the physical plant to enhance the company’s image and expects the buyer to cover overmarket amenities. This occurs most often with office buildings, but overimproved industrial facilities can be even more difficult to evaluate since the perception of overimprovement is related to the location as well as to the building itself.

Developer. From a logistics standpoint, developers are relatively straightforward, since they are professionals who will have the information you need readily available. As always, consider the seller’s motivations. The developer’s first objective is to build. With a lease in hand, the developer can get construction financing and create the product. The second objective is to sell at a profit, so it is necessary to build a return into the transaction. However, the developer’s costs may be relatively low because of economies of scale in creating a large amount of product. One of the benefits is that the lease is already drawn, and a meticulous analysis of the terms virtually can eliminate the chance of contractual surprises during your client’s ownership.

The main potential downside is that there is no performance history for the site. Second, even experienced developers sometimes give in to a strong tenant’s demands, even though the terms may be detrimental to the property’s investment value.

Armchair Investments

Carefully structured and underwritten, a triple-net-leased real estate investment can be an armchair type of investment. However, before an investor commits capital to such a long-term investment vehicle, pre-acquisition due diligence is paramount. Real estate advisers must ascertain the degree to which the lease is, in fact, a triple-net, the likelihood that the tenant will succeed, and the suitability of the real estate itself for the proposed and subsequent use. Finally, match all of these components to the unique characteristics and goals of the investor to determine if this type of property is a right fit.

One of the signs of the times that indicates how any nation’s economy is doing can often be determined by how well businesses are expanding in real estate. Right now, there is a continued expansion of commercial real estate and loans for these new projects. The current commercial real estate lending trends indicate that now is a good time to expand your business with a building program or new land purchase.

While the housing market has certainly taken a real dip, and has hurt the sub prime lenders in particular, commercial lending goes on. Many new projects, especially in the income producing properties realm, is seeing solid expansion. This includes the construction of office parks and buildings, multi-family dwellings, hotels, and other general land development programs.

One particular market that has held up its own is office rentals. The demand for office space – even at increased rent values – has grown. This is especially true in New York City (Manhattan), and some other large cities, too. This means that the available office rental space has actually decreased as office space is being filled – much to the owner’s delight. In New York City, office space is being grabbed up – even though the rent has risen to nearly $70 per square foot.

A few other cities, however, still show a slow office rent market. In fact, much office space remains unoccupied. In those cities, though, where office space is in demand, the number of office buildings and office parks are certainly on the rise, as developers rush to fill in the gap. Commercial lenders are also seeing the need and providing the necessary bridge loans and commercial loans for these massive projects.

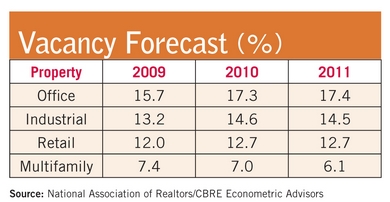

When compared to last year, there is an increase in the overall amount of activity in commercial real estate lending. This shows a growth of about 0.8 percent that is expected in the third quarter of 2007, according to the National Association of Realtors.

Over the last few years, commercial real estate lending has shown a strong increase. The Federal Reserve (Philadelphia) indicates that large mortgage lenders have gone from about 150% of loans (compared to non-commercial) back in the 1990’s, to over 300% last year.

The number of commercial real estate loans is increasing and lenders are continuing to offer excellent interest rates. The market has begun to show a slight decrease in recent days, but for right now, the rates needed to expand business could not be much better. The qualifications needed to get such a loan also could not be much softer than they are right now, too.

Seeing this kind of commercial real estate trend, and the market’s favor for this kind of loan, you also may be able to benefit greatly by investing now in a new building project or land development program. Check on availability of office space (in particular) in the area, find out how fast it is being secured by new businesses, and if it is in demand, be ready to move on the opportunity. Scope out possible land available, or existing structures that can easily be renovated into office space, get your paperwork in order, and talk to a commercial lender about your goals before someone beats you to it. Now is the best time for action on this kind of opportunity, while commercial loans are still available at great terms.

Please visit SNC Commercial Loans. You can also find more information on direct lending.

If the agent Charles Schumer has his way, things could change for the industry constantly in the center of alarm. The agent wants to admit that gets legislation binding on all alarm units located in the heart of America to pay a tax if the disturbance calls to a non-American. The move comes at a time when the President of the United States, Barack Obama, is already looking at ways in which to reduce the transfer of American BPO jobs to other countries said. The tax was on the horizon always exists. Obama has talked about a way to stop the black hole of American jobs overseas to countries if progress added to the presidential election. Agent councilors angle Schumer is a footprint in that direction.

There is plenty of argument in this motion. That’s for sure. If you are a native American who has been given the blooper blush recently, I now feel blessed about this movement is progressing fruition. However, if you are a native American who has about a business plan to outsource to BPO units in countries like India and the Philippines adopted, this move could mean the end of an era. Meet no mistake: I am not suggesting that the tax plan will stop the alarm at the center to get engaged on the countries added. I am saying that with this tax in place, there are many commercial companies are expected in casework quiet located in the alarm center to accommodate your needs. Without doubt, the absolute compression imposed some money from business firms to countries requesting alteration added. In this bad economy, any compression that hurts business enterprises.

Barter BPO analysts agree somewhat altered to action in this debate. Richard McConnell, one located in central alarm management consultant, feels, “Schumer Agent Legislation absolutely affect the industry has to answer. But for the absolute performance of the wind axis labor scares located in the center added countries is too abundant and the population for granted. “Affidavit McConnell to admit the tax of 25 cents per alarm that is transferred outside of America, the amount of business that companies cut get by hiring an outsourcing company in the country near the third world is still quite heavy for a viable business. There is no agnosticism in the reality of business that investors would be to hold a trial on the amount above yield a final call.

If you go by test experts barter, you can be sure that the blow may move could could cause a cavity in the breeze alarm plan at the center of approved destinations, but will never be able to abundant alarms accession. By law to cover the charge that any alarm that goes outside America have to be labeled as well. In added words, callers will he realized his alarm is being transferred and the country. Now this is something that could could cause a nuisance to the business appointment call centers adopted BPO business. The addition may feel it is to travel with him added amount for the call. The addition can abstract for this reason. The telemarketing industry has to ensure that callers get the newsletter if your alarm before being transferred.

http://weddingbandss.blogspot.com/

http://www.indyarocks.com/profile/profile_vview_main.php?uid=4658446

Twitter

Twitter

LinkedIn

LinkedIn

YouTube

YouTube

Facebook

Facebook