Industrial

Los Angeles County apartment market will gain traction as rehiring efforts boost rental household formation and completions. Los Angeles Apartment Sales will pick up.

Cap rates were pushed down for Class A and well-located Class B product to 6-percent range. Cap rates for assets with some level of distress and located in perimeter areas will average above 7 percent in the early part of 2011.

2011 Market Outlook

· 2011 NAI Rank: 11, Up 2 Places. Los Angeles into the top 10 apartment market.

· Employment Forecast: 1.5% gain.

· Vacancy Forecast: 4.4 % this year.

· Rent Forecast: Rents will advance 2.7%.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Inland Empire apartment operations will strengthen in 2011 as payroll expansion resumes and the pace of new construction remains constrained. Job gains will become a primary driver of renter demand growth. Total employment will post net gains for the first time since 2006, and occupancies will continue to rise, led by strong absorption.

Apartment Investment activity in the region will continue to improve in 2011 as long-term hold buyers purchase bank-owned assets. Opportunities to acquire REO listings and value-add properties will remain prevalent. Cap rates for these assets will average in the mid-7 percent to low-8 percent range this year. Demand for assets closer to Los Angeles County employment centers will outstrip supply.

2011 Market Outlook

· 2011 National Rank: 32, Up 5 Places. Inland Empire kept the market in the bottom 1/3 of the ranking.

· Employment Forecast: Total employment in the two-county region will expand by 1.5%.

· Vacancy Forecast: Average vacancy rate will fall approximately 100 basis points this year to 7%.

· Rent Forecast: Effective rents will increase 2.2%.

· Investment Forecast: Although REO and top-tier deals will dominate sales this year, some unique opportunities will emerge.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

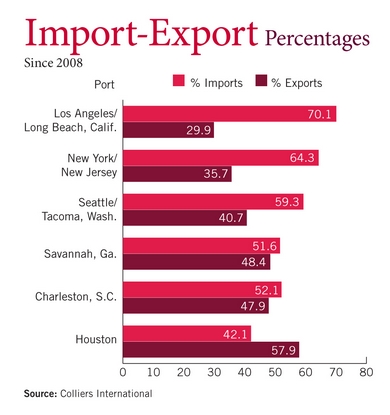

Export Advantage

The decline in global trade hit the nation’s industrial markets hard, but not equally hard, according to a Colliers International report. During the global slowdown of the past two years, vacancy rates in port city industrial markets climbed faster than in the overall industrial market. This points up the clear correlation between trade and industrial demand. For every 1 percent change in port TEUs, the standard measure of shipping trade, industrial demand changes 0.33 percent. So the recent 15 percent decrease in TEUs resulted in a 5 percent decline in port city industrial occupancy. But not all port cities experienced the decline equally. In fact, those focusing on exports fared better than those concentrating on imports, as exports to foreign countries remained fairly stable throughout the recession.

Increased import and export business as we come of the recession will benefit Long Beach and Los Angeles County, but also the Inland Empire where most of the goods are warehoused. This is good news for commercial property owners in Los Angeles and San Bernardino. Los Angeles Apartments for Sale, Orange County Apartments for Sale, and San Bernardino Apartments for Sale will benefit.

Michael Duhs, Managing Broker

East West Commercial

(949) 939-8352

Michael.Duhs@EastWestCommercial.com

Twitter

Twitter

LinkedIn

LinkedIn

YouTube

YouTube

Facebook

Facebook